Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

As Africa's leading and longest running contemporary art fair, FNB Art Joburg's mandate is to sustainably support and grow the continent's cultural offering in ways that go beyond the fair. One of the ways this is achieved is through the annual FNB Art Prize. For its 14th year, FNB Art Joburg is proud to announce the winner of the 2024 FNB Art Prize: Gresham Tapiwa Nyaude.

FNB is pleased to announce the appointment of La-Cell Mouton as the bank's Chief Information Officer (CIO). This appointment will provide additional capacity for the CIO teams across the business. La-Cell joined the bank in 2000 as a Developer for the BANKit Online Banking system. From 2005 - 2007, he was part of a team that migrated the original Online Banking system and BANKit into a single platform, forming the current Online Banking offering.

According to FNB's Retirement Insights Survey, less than 10% of South Africans retire comfortably. This is just one of the many concerning pieces of data from the latest edition of the annual survey. But what does the introduction of the two-pot retirement system from 1 September 2024 mean for those who are ill-prepared for retirement?

The latest 2024 FNB Retirement Insights Survey unveiled the startling reality that almost 50% of the respondents don't have a retirement plan in place. This lack of preparation for retirement isn't just a personal financial risk, it's also a potential crisis that could send shockwaves through their families and negatively impact future generations. That's because, without adequate retirement savings, individuals may find themselves relying heavily on their children and other family members for financial support, creating a severe strain that can prevent the ability of the next generation to prepare properly for their own retirement.

The introduction of the two-pot system, together with possible interest rate cuts, decent momentum in wages, and lower inflation could boost consumer confidence and drive an increase in spending in the months ahead. This is expected to be positive for domestic retailers, particularly discretionary names (clothing and furniture mainly). There could also be some benefit accruing to the banks, as savers may utilise their withdrawals to pay down debt, which could improve asset quality and free up capital to drive higher quality loan origination as well as higher transaction activity.

FNB eBucks is proud to announce its collaboration with Pick n Pay to offer qualifying FNB customers a loaf of bread every week for 99c through a voucher initiative at all stores nationwide. From 1 September, FNB Easy PAYU and Easy Bundle customers can purchase up to four loaves a month at 99c per loaf by swiping their cards for any amount when purchasing goods at Pick n Pay stores. The 99c bread offer will no longer be available at Shoprite stores, although FNB customers will continue to earn rewards at Checkers and Shoprite.

Following the South African Reserve Bank's (SARB) decision earlier today to lower its benchmark Repo Rate by 0.25%, FNB will reduce its interest rates on prime-linked accounts with effect from Friday, 20 September. FNB CEO Harry Kellan says, "We welcome the SARB's rate cut as it consistent with the global trend towards lower interest rates. However, we do not anticipate a major cutting cycle. Inflation expectations remain above the Reserve Bank's target mid-range of 4.5%, with average inflation expectation for 2024 at around 5%, though it is expected to decline next year."

FNB's rewards programme, eBucks, has achieved remarkable recognition by winning six prestigious awards at the 2024 South African Loyalty Awards - This milestone reaffirms eBucks as the leading rewards programme in the country.

In another move to provide diverse investment opportunities for South African investors, FNB released the third tranche of its widely acclaimed Structured Products. Designed to deliver robust returns while safeguarding capital, these innovative investment solutions are a powerful tool for investors seeking to diversify their portfolios in today's volatile economic environment.

Following the South African Reserved Bank's decision earlier today to keep interest rates at the previous level. FNB confirms that it will hold its prime lending rate at present levels and will review its position after the next SARB MPC meeting in July.

The rising cost of living and high interest rates are challenging consumers to seek out alternative ways of buying homes.

With the rising cost of living and Eskom's tariff increase of 12.74%, getting a solar system is not just about reducing the impact of loadshedding, but to free up \cashflow for other household needs.

Since FNB announced its plans to improve the operational resilience of its ATM network across the country by installing over 1,000 standalone ATMs with Uninterruptible Power Supply (UPS) systems, the b ank confirmed it has now installed UPS systems at 900 ATMs, with 100 more installations planned for roll-out by the end of June 2024.

In recent years, market uncertainty has become the norm, leaving most investors actively searching for opportunities that offer them stability and long-term growth potential while limiting volatility in the face of constantly shifting economic sands.

First National Bank (FNB) has expanded its extensive Exchange-Traded Note (ETN) offering with the introduction of eight new ETNs. The new offerings, which bring the bank's popular range of ETNs to a total of 50, are designed to give South African investors easy and affordable access to leading companies operating in the pivotal global sectors of AI and technology, tourism and travel, pharmaceuticals, and cybersecurity.

Compelling pricing, easy-to-use products and practical value, are the hallmarks of FNB's annual pricing review. By simplifying products, offering consistently transparent pricing and adding value with useful benefits that customers want and need, FNB is focusing on being a meaningful partner in the lives of its customers.

More often than not, people take up insurance policies without informing beneficiaries of the existence of these policies. This makes it harder for loved ones to access the risk benefits that are due to them, when policyholders pass away.

FNB Connect, one of South Africa's leading Mobile Virtual Network Operators (MVNO), is thrilled to announce the expansion of its highly popular data offering with the launch of a 15GB (30-day) mobile data bundle promotion for only R199.

The Springboks' opening fixture of the 2024 season against Wales at Twickenham on Saturday sees five Springboks continuing their "Grassroots to Greatness" journey with FNB.

The Springboks' opening fixture of the 2024 season against Wales at Twickenham on Saturday sees five Springboks continuing their "Grassroots to Greatness" journey with FNB.

Gold along with cash and certain other instruments is genrally regarded as a safe haven asset tend to provide relief to a portfolio during times of market stress.

FNB has seen a strong demand from clients buying Krugerrands on its trading platforms as consumers embrace alternative asset classes to diversify their investment portfolios. Over the last year, FNB assisted with facilitating the delivery of over 2 200 Krugerrands on its trading platforms.

As global investment markets have increasingly become characterised by uncertainty and volatility; a growing number of investors are recognising the value of Exchange Traded Funds (ETFs) as a way of achieving diverse market exposure through a single investment transaction.

Stokvels are a way of life for many South Africans, and an integral part of the country's economic landscape. These collective schemes are a phenomenon with immense potential that is yet to be fully unlocked.

Getting a financial windfall can come from various sources such as an inheritance or winning a lottery. A financial windfall might change your life and present you with a lot of financial opportunities, however, if you don't utilise it wisely it may create unpleasant moments.

For most people, purchasing a home represents the largest investment they will ever undertake, and carries emotional significance as a symbol of stability, security, and achievement. Property can offer much more than just a place to live - and it can also be a powerful investment vehicle capable of generating wealth, providing liquidity, enhancing cash flow, and diversifying one's portfolio.

There is a growing opportunity for innovative "social entrepreneurs" to solve social, economic and environmental challenges while building profitable and sustainable businesses. The idea of combining profit-making with purpose-driven positive social impact has challenged the traditional notion that the two endeavours are mutually exclusive.

As payment methods become more sophisticated, so are the cybercriminals who are exploiting consumers who are insufficiently informed about how digital wallets work.

South Africa's new 'two-pot' retirement system was signed into law by President Cyril Ramaphosa on the 1st of June 2024. According to a statement by the Presidency, the Revenue Laws Amendment Bill of 2023, which established a 'two-pot' system gives members access to retirement savings without having to resign or cash out their entire pension funds. It also confirms the effective date of 1 September 2024

With the rising cost of living and Eskom's tariff increase of 12.74%, getting a solar system is not just about reducing the impact of loadshedding, but to free up cashflow for other household needs.

FNB Art Joburg will return to Sandton Convention Centre for its 17th edition.

Fine dining, crockery and pots, flowers and jewellery continue to enjoy the lion's share of consumer spend leading up and during Mother's Day while biltong and winery dominate spend in the same period for Father's Day. According to FNB data, on Mother's Day in 2024, its customers spent approximately R50 million compared to R38.8 million weekly average.

On May 30th , the South African Reserve Bank (SARB) announced its decision to keep interest rates at 8.25%. Subsequently, banks and other financial service providers will hold their prime lending rate at present levels and will review after the next SARB's Monetary Policy Committee (MPC) meeting in July.

FNB welcomes the release of the Ombudsman for Banking Services' annual report for 2023, which includes the management of disputes between banks and customers. The Ombudsman has acknowledged FNB as the Bank with the quickest turnaround time to close complaints.

As South Africa commemorates Savings Month this month, the country's financial landscape presents a unique opportunity for retail investors to bolster their savings. Interest rates continue to hover at elevated levels and the predictions are that there will only be gradual decreases in the latter part of the year. This means that Savings Month is an opportune moment for South Africans to reassess and optimise their saving strategies.

The 2024 FNB Retirement Insights Survey, released today, offers a glimpse into the current state and evolving dynamics of pre- and post-retirement planning in South Africa. In its second year, the in-depth research reveals persistent challenges around retirement in South Africa and highlights emerging opportunities that could significantly shape the future of retirement preparedness in the country.

If you need a quick lending solution that will give you access to funds at an attractive interest rate, then securities-based lending (SBL) might present a solution tailored to your needs.

It might seem backwards but the best time to save is when the economy is though. Being intentional about saving money during difficult economic times is just as important as saving when life is good. Think of it this way: the incredibly high interest rates that make borrowing so expensive are the same high interest rates that will mean that consumers can get more bang for buck on their savings.

There is an increase in phishing and smishing attempts aimed at loading debit and credit cards onto criminals' digital wallets. With cybercriminals becoming more sophisticated, consumers must remain vigilant and take proactive measures to protect themselves.

Following the South African Reserve Bank's decision earlier today to leave its repo rate unchanged, FNB confirms it will maintain its prime-linked accounts at existing interest levels and will review this position after the next SARB MPC meeting in September.

Franchising is often seen as an easy way to start, own and run a business. But while franchising has definite advantages, buying a franchise is certainly not a guarantee of long-term financial success.

Farming is a long game that requires patience, perseverance, and strategic planning across all aspects of the operation. While every farmer understands this when it comes to tending crops and raising livestock, the same can't always be said for managing their finances; and taking a short-sighted approach to financial planning can be as devastating to a farmer's livelihood as a flood or drought would be to his or her operations.

Following its brand overhaul in 2022, First National Bank (FNB) has been named the Strongest Brand in South Africa by Brand Finance, boasting a brand strength score of 92 out of 100. According to Brand Finance, the Strongest Brand in South Africa accolade was determined by a combination of factors including the bank's strategic shift towards positioning itself as more advisory-focused, rather than merely product-oriented.

First National Bank's (FNB's) eBucks rewards programme has been announced as the Best Loyalty Benefits in a Financial Product at the 2024 International Loyalty Awards. The awards recognise excellence and innovation among brands that go beyond expectations to create engaging loyalty programmes in their industry.

FNB has announced the launch of a new savings feature which allows Easy PAYU (Pay-As-You-Use) and Easy Smart customers to earn 5.4% interest on their transactional accounts, provided they keep a positive balance. To give more value to customers, FNB has included an interest redirect tool to automatically transfer all the interest earned on the account monthly into an FNB Savings account that is free and forms part of the overall Easy PAYU and Easy Smart value proposition.

The beginning of the year is an ideal time to assess your overall wealth plan and to plan for your family's future and legacy. Given the emphasis on the economic and sustainable challenges, intentional impact investments should be included as part of your overall wealth plan which will help create measurable and positive impact. Impact investing has disrupted this paradigm and provided new avenues for amplifying your philanthropic goals.

FNB is proud to announce that the FNB Top 40 exchange-traded-fund (ETF) has been recognised as South Africa's best exchange traded product (ETP), when considering tracking efficiency over three years with reference to South African equities, in the annual South African Listed Tracker Awards (SALTA), for the third consecutive year.

Stokvels continue to show tenacity and commitment in promoting a savings culture in South Africa despite the tough economic environment, this is shown by the 15% increase in net deposits, surpassing the R9.6-billion mark in total member contributions over the past year.

FNB tax-free savings account balances grew by 21% year-on-year and volumes increased by 18% year-on-year as customers continue to embrace tax-free savings benefits and take advantage of the high interest rate environment over the past year.

While Semigrating has always been a relatively common and growing trend for many South Africans, FNB's latest Property Barometer highlighted that buying activities in the affluent market dropped sharply in 2023 weighing on property values. In addition, semigration trend is normalising, providing less support to high-end property demand in coastal towns.

In a bid to address the housing shortage in the City of Johannesburg by providing formalised and quality affordable housing while promoting economic development and job creation, the Orlando Ekhaya housing precinct development located in the heart of Soweto, is making rapid progress.

In 2007 the Sundays River Farming Trust was formed by citrus workers in Sundays River Valley in the Eastern Cape. The trust was granted 30-year leases to work four citrus farms in the area, but, because government would not permit them to purchase the land outright, the members struggled to access financing to grow their operations.

Headline inflation accelerated faster to 5.6% y/y in February from 5.3% in January 2024, which is slightly above market expectations of 5.5% y/y. The monthly headline inflation outcome was 1% m/m. However, food inflation decelerated faster to the lowest level in twenty-five months at 6% y/y in February from 7% y/y in January. Except for the sugar, sweets and deserts which remained flat, the rest of the food subcategories decelerated with oils and fats extending their trend in negative territory. Oils and fats inflation has been trending negatively for the past ten months which is line with the trend on the international market.

FNB Service Provider has expanded its electricity coverage by increasing the municipalities it covers to 148 of 164. The expansion, which accounts for over 90% of municipalities in the country, will allow more FNB banked customers to purchase electricity easily and conveniently on the award-winning banking channels.

Following the South African Reserve Bank's decision earlier today to leave its benchmark rate unchanged, FNB will maintain its prime lending rate at existing levels and will review its position after the next SARB MPC meeting in May.

Protecting your family is a fundamental part of ones' long-term financial planning goals. It is not as simple as just taking out R1 million worth of life cover and leaving it there, but it involves much more.

For the second year running, the Euromoney Awards have crowned FNB as Africa's Best International Private Bank in Botswana and Namibia as well as Africa's Best Bank for Ultra High-Net-Worth Individuals, Discretionary Portfolio Management, Philanthropic Advisory, Succession Planning and Sustainability.

FNB has launched its Estate Protector benefit to help customers cover costs associated with the administration of their deceased estate. The FNB Estate Protector benefit will be used to settle the customer's Executor's fees and any costs associated with the administration of one's deceased estate.

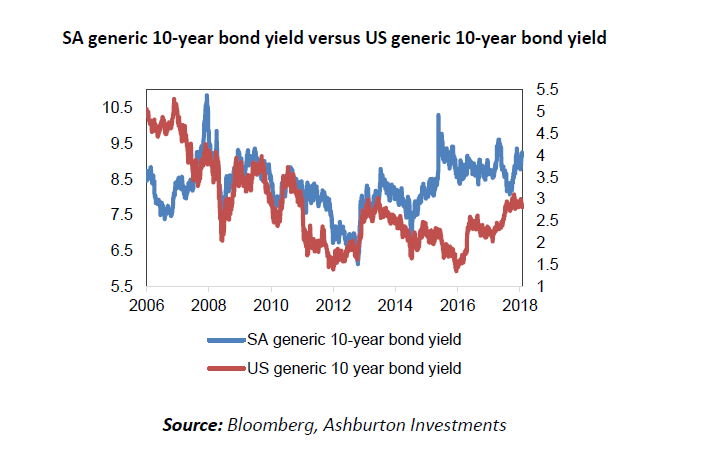

The global economic backdrop continues to improve gradually but great amounts of uncertainty remain. While most of the major central banks are now likely approaching the peak of their rate hiking cycles, inflation remains high and sustained high levels of interest are having a dampening impact on economic growth. Meanwhile, the recovery in China's economy has been uneven and mixed economic data has made it difficult to interpret to what extent a post-Covid lockdown rebound in the world's second largest economy will be able to lift the near-term global growth outlook.

RMB Private Bank has once again been named South Africa's Best Private Bank for Ultra High Net Worth Individuals for the 2nd year in a row, adding to the newly awarded categories of South Africa's Best Private Bank for Discretionary Portfolio Management, Succession Planning and Sustainability awards at Euromoney's 2024 Private Banking Awards.

We live in a world where borders have become grey lines, separating continents with the mere click of a button. Given the vastness of our geopolitical landscape, the distribution of your assets upon your death can be complicated not only from a local point of view but also from an offshore perspective.

The recent Citrus Growers' Association of Southern Africa (CGA)'s announcement that there would be an additional direct shipping service from the ports of Ngqura and Gqeberha (Port Elizabeth) for the export of citrus is most welcome and a good development for the industry. MSC is a global container shipping leader and has provided the citrus industry with shipping services for many years according to the CGA. The additional service, which entails running every Tuesday from the end of May to the beginning of September, is well-timed ahead of the citrus export season.

Amid tight fiscal conditions, South Africa's Finance Minister Enoch Godongwana managed to deliver a modest expenditure plan and hopefully implementation is expected to unlock and accelerate economic activity. A few positive points for the agriculture sector include no increase in the general fuel levy for 2024/25 which will alleviate pressure on the sector as it accounts for almost 13% of production costs in the grain sector and critical for distribution of produce to markets.

Farmers in South Africa are among the business owners who are often hardest hit by the compounding pressures of domestic economic challenges and international turmoil. The current environment is fraught with uncertainty thanks to unrelenting load-shedding, escalating petrol prices, and unprecedented increases in electricity costs, among other challenges.

Over the past two decades the concept of social entrepreneurship has gained increasing attention and recognition. The idea of combining profit-making with positive social impact has sparked a global movement, challenging the traditional notion that the two endeavours are mutually exclusive.

At a time when financial literacy and good money management are more crucial than ever, First National Bank (FNB) is reshaping the conversation around credit; moving away from the traditional view of it as a financial trap that's better avoided, to highlighting its potential as a key to unlocking a better life, if used responsibly.

According to the Solidarity Bank Charges Report 2024, FNB's Easy PAYU and Aspire bank accounts offer the best value for money to customers in South Africa. This is the third consecutive year that FNB has been recognised by the Institute for work being done to make their accounts affordable to customers.

FNB eBucks is proud to announce its partnership with SPAR, one of the country's leading food retailers. From February, FNB Private clients, Private Wealth and RMB Private Bank clients will earn up to 15% back in eBucks when they shop in-store at SPAR, SUPERSPAR, KWIKSPAR and TOPS using their qualifying FNB or RMB Private Bank virtual cards.

FNB and RMB have jointly been recognised as Africa's Best Foreign Exchange Providers at the 24th annual World's Best Foreign Exchange Provider awards, held by Global Finance. In addition, RMB Namibia was announced as the Best Foreign Exchange Bank in the country as part of the Gordon Platt Foreign Exchange Awards.

In recent years, increasing numbers of South Africans have been made aware of the importance of having a signed will. Individuals with any type of property or assets - whether a house, car, pension fund, life insurance policy, or even savings account - has an estate; and resolving that estate quickly and effectively after they pass away is crucial to ensure that loved ones receive their rightful inheritance.

Ask any trapeze artist, and they'll tell you that a safety net is a non-negotiable part od flying high. While few of us are circus performers, an emergency savings fund is still one of the most important requirements for our peace of mind and financial stability.

A rapidly shifting investment landscape, marked by pronounced volatility on a global scale, has made it challenging for investors to navigate some challenging terrains.

Thinking about life cover insurance can feel overwhelming because it takes us to a place where the worst has happened, the loss of a loved one. In a world where insurance can feel overwhelming, complex, and intimidating, the simplest way to think about your life cover insurance is that it is a promise to offer a financial shield to those left behind. Life insurance cover is shaped by who you are and where you are in your life but at its core, it is part of the legacy we leave our families.

January 2024: FNB has been certified as a Top Employer in South Africa by The Top Employers Institute® for 2024 for the second consecutive year. The accolade recognises FNB's unwavering commitment to creating a better workplace through excellent human capital strategies aligned with the new world of work, policies, and dynamic practices that support an everchanging world of work.

January 2024: Following the South African Reserve Bank's decision earlier today to leave its repo rate unchanged, FNB confirms that its prime lending rate will remain at present levels and will be reviewed following the next meeting of SARB's Monetary Policy Committee in March 2023.

January 2024: The New Year provides an opportune time for one to reflect, take stock and review their insurance covers to ensure that they are financially prepared to handle any unexpected events throughout the year. Fact of the matter is that life is full of uncertainty, and none of us can predict what lies ahead. While we often focus on living life to the fullest, the well-being and safety of our loved ones is equally important.

January 2024: Last year was yet another volatile year in global equity markets and another year in which the JSE underperformed most major international markets. The S&P 500 had a bumper showing after a difficult 2022 as the AI revolution gave impetus to the technology sector and saw a few new tech giants come to the fore. The Chinese market struggled as a much-anticipated reopening of that economy failed to materialise in the strong growth that was anticipated at the start of 2023.

January 2024: As we kick off the year, investors and market analysts are gearing up for what promises to be an eventful 2024 with both potential challenges and opportunities lying ahead. With a global economy in a state of continuous transformation, several key market trends are set to shape the investment landscape this year

January 2024: With the start of the new year upon us, the need to remain vigilant when using or managing your money remains important, more so for seniors who are (in some cases) considered more vulnerable and are seen as easy targets.

January 2024: With the new year upon us, there is no better time to assess your financial position to ensure that you stay on track in achieving your financial goals well into the future. However, this requires one to prioritise your savings plan and ensure that you are contributing to the right savings vehicles that aligns to your financial goals.

January 2024: Private school education is one of the largest expenses for some households and tuition fees as well as boarding fees at the country's private schools can cost as much as R300,000 a year. Considering these fees and the generally high cost of living, families who prefer to send their kids to private schools in the country or abroad should not underestimate the importance of planning well in advance.

December 2023: A majority of people looking to wind down and enjoy quality time with friends and family over the holiday season, for some businesses this is the bussiest time of the year, where they get to make most of their profits.

December 2023: FNB in collaboration with regional NGOs and volunteer groups - including the Two Oceans Aquarium Foundation, Clean C, Adopt A River Eco Solutions, Zwartkops Conservancy, and Zero Waste for Recycling - is proud to announce the launch of an extensive Beach Clean-up campaign.

December 2023: For most people, the festive season is a time for giving, caring and spreading joy. In this spirit, FNB has ushered in the 2023 festive season with a call to all South Africans to support the pillars of their communities, namely local small and medium-sized businesses.

December 2023: First National Bank (FNB), one of the oldest and largest banks in South Africa has collaborated with Oracle to modernise Ponelopele Secondary School in Tembisa. The school offers free education to the local community and fosters an interest in fields of STEM and IT. A special inauguration ceremony was organised at the school premises on Friday to celebrate the occasion.

December 2023: Gifting your loved ones with traditional gifts this festive season is great, but have you ever thought of gifting shares. ETFs, ETNs or even a Unit Trust as an investment for the future and a gift that has the ability to keep on giving?

December 2023: For decades, stokvels have played a significant role in encouraging the culture of saving and helping people achieve their financial goals. Despite the callenging economic environment, stokvels continue to show growth and evolve as they continue to serve additional purpose other than what they were traditionally created for.

December 2023: With the holiday season upon us once again, most people are looking forward to their upcoming holidays, with international travel being on the top of the list for many. Given the logistics involved in an international trip, extensive planning and preperation is key to avoid any dissapointments and excessive spending.

13 December 2023: FNB, in partnership with Visa and the N3 Toll Concession, introduces secure and convenient contactless card payments. Toll plazas will be equipped with new-age card acceptance devices to reduce time spent at booths and to combat fraud.

09 January 2023: Product Head of Wills and Deceased Banking at FNB Fiduciary, Carin Meyer, highlights how families can protect their estates and inheritances against fraud this new year.

24 November 2022: Following the South African Reserve Bank's (SARB's) decision to increase its repo rate by 0.75%, FNB will raise its prime lending rate by 0.75%. As international trends indicate an uncertain outlook, it is even more critical for our country to stay the course in its monetary policy decisions.

14 December 2022: It's important for Stokvel members who plan to withdraw or share their group savings to be aware that fraudsters are looking for ways to defraud them of their hard-earned money.

14 November 2022: Stokvels urged to take advantage of rising interest rates. FNB reveals that Stokvel members who use its no monthly account fee digital account have contributed over R1.8 billion since the solution was launched in 2020.

30 October 2022: CEO of FNB Cash Investments, Himal Parbhoo touches on World Savings Day and South Africa's low savings culture. He also highlights the different ways we can activate the discipline of saving.

13 October 2022: Stokvels are a genuine vehicle that many South Africans of all ages and income groups choose to help them save towards achieving a collective financial goal. Sifiso Nkosi, Stokvels and Group Savings Head at FNB Cash Investments, explains how stokvels fulfil some of the needs that individuals have, in order to support their wealth creation journey for their next generation.

7 October 2022: FNB is reimagininghelp as it strives to make every day easier and tomorrow better for all its customers,taking a bold step forward on its journey into the future.

06 October 2022: Given the uncertainty and volatility that has characterised investment markets in recent years, many people are looking for ways of supplementing the retirement savings.

22 September 2022: The South African Reserve Bank (SARB) has increased its repo rate by 0.75%. FNB CEO, Jacques Celliers and FNB Chief Economist, Mamello Matikinca-Ngwenya, explore this further.

21 September 2022: Head of Investments at FNB Wealth and Investments, Renzi Thirumalai shares his thoughts on the recent five-star rating from the highly respected global investment research provider, Morningstar.

14 September 2022: A Will should serve as a blueprint for your life and financial planning journey. FNB shares a few considerations when it comes to setting your estate plan and then ultimately how you draft your Will.

04 September 2022: The two-pot system will see one third of the money you invest in your retirement fund being placed in an accessible savings pot, while the remaining two thirds will be held in a retirement pot, which you will not be able to access until you retire.

23 August 2022: FNB and RMB Private Bank customers with Android-powered smartphones, tablets, or watches can now also use Google Wallet for safer and more secure contactless payments. Retail customers can now link their physical and virtual FNB debit, fusion, or credit cards to Google Wallet, while Commercial clients can link their physical and virtual debit cards.

22 August 2022: Saving and investing early on in life gives you a greater chance of growing and protecting your wealth. Samukelo Zwane, Head of Product, FNB Wealth and Investments talks about how financial and investment education is key to unlocking sustainable returns into adulthood.

24 July 2022: With the recent Monetary Policy Committee (MPC) further increasing the repo rate, FNB Wealth and Investments Solutions CEO, Bheki Mkhize, touches on the increase in interest rates and breaks down the impact on equity stocks, focussing on how it will differ per sector.

21 July 2022: FNB CEO, Jacques Celliers commented that the South African Reserve Bank's rate hike aligned with global trends to curb inflation and cautioned that further rate hikes by the central bank are a possibility in the coming months.

12 May 2022: Comrades Marathon Association (CMA) Chairperson, Mqondisi Ngcobo proudly announced the new FNB sponsorship and the FNB Brand Experience Head, Bonga Sebesho also shared his thoughts.

12 May 2022: FNB CEO, Jacques Celliers touches on the release of the Ombudsman's 2021 Annual Report and its critical role in assisting customers and banks resolve complaints.

09 May 2022: CEO of FNB Retail, Raj Makanjee touches on the success of the innovative Bank Your Change® feature, alongside CEO of Cash Investments for FNB Retail, Himal Parbhoo, who also shares his thoughts.

03 April 2022: FNB Top 40 exchange-traded-fund (ETF) has been voted as South Africa's best exchange traded product (ETP), when considering tracking efficiency over three years, in the annual South African Listed Tracker Awards (SALTA).Bheki Mkhize, Head of FNB Wealth and Investment Solutions, explains why this award is a major feat for us and highlights our commitment to enabling better and simpler access to the stock market.

16 March 2022: Significantly more investment accounts were opened by clients between June and December 2021. As part of FNB's focus of becoming an integrated financial services provider that is relevant to customers' needs, FNB Wealth and Investment's proposition is attracting clients who are new to investing.

25 March 2022: 24 March 2022, Johannesburg: Following the South African Reserve Bank's (SARB's) decision to raise its repo rate by 0.25%, FNB will adjust its prime rate by 0.25% with effect from Friday, 25 March 2022.

03 March 2022: The bank's ongoing investment in its digital platform continued to yield results with an increase in digitally active customers. FNB CEO Jacques Celliers said that the results demonstrated the bank's ability to help and remain relevant to its customers.

17 February 2022: Great news for both FNB customers and RMB Private Bank clients, as they can now access a private 72-hour pre-sale opportunity to purchase tickets for the Rugby World Cup Sevens 2022 in Cape Town. FNB Chief Marketing Officer, Faye Mfikwe elaborates further.

15 February 2022: We are fast-approaching the end of the tax season making it the best time to look at your Tax-Free Savings Account and identify how you can take advantage of savings incentives.

13 February 2022: Just because it is the month of love doesn't mean you should stop being vigilant with your finances. Fraudsters look for opportunities to like these to scam and defraud you, don't let last-minute decisions result in you letting your guard down when browsing online. Read these tips from FNB to navigate the month of love.

11 February 2022: First National Bank (FNB) is an official Global Partner of Rugby World Cup Sevens 2022 (RWC7s), which will take place from 9 -11 September 2022 at the Cape Town Stadium in South Africa. 'The RWC7s 2022 South Africa is another opportunity for us to continue living our legacy of 'help', 'hope' and 'togetherness', said FNB CEO, Jacques Celliers.

07 February 2022: FNB now offers a fast and uncomplicated way for clients to start, or accelerate, their retirement savings journey, using the FNB Banking App. With no lengthy forms to fill out, no financial advisor commission payments and no investment processing fees, this is just another way we aim to assist customers throughout their money management journey.

27 January 2022: FNB CEO Jacques Celliers said the Reserve Bank's decision to adjust rates were indicative of a recovery in underlying economic activity. He added that normal operating conditions would be conducive to broad-based economic recovery and benefit the sectors impacted by the pandemic.

26 January 2021: Before emigrating, it is vital to consider the financial and opportunity cost implications of moving your local retirement funds offshore. Samukelo Zwane, Head of Product at FNB Wealth and Investment, advised South Africans to be cautious without letting fear influence their decisions.

27 January 2022: FNB CEO Jacques Celliers said the Reserve Bankâs decision to adjust rates were indicative of a recovery in underlying economic activity. He added that normal operating conditions would be conducive to broad-based economic recovery and benefit the sectors impacted by the pandemic.

20 January 2022: It's time to set new goals for the year ahead. Just like your lunchbox, you can make better and healthier financial decisions. Let the experts tell you more.

21 December 2021: As 2021 draws to an end, it is important to re-evaluate your long-term financial planning, by updating your estate planning (which includes your Wills and Trust affairs). Matlhodi Leteane, Head of Operations, FNB Fiduciary, offers useful tips on what you need to consider when reviewing it this holiday season.

13 December 2021: In celebration of the first cycle of a refreshed Innovators Programme, FNB CEO, Jacques Celliers, shares how the Innovators Programme is designed to help customers with pain points in their money management journey, whilst positively impacting customers in all corners of society, across Africa.

07 December 2021: With the festive season upon us, Head of Fraud at FNB Wealth and Investments, Ramesh Ramdeen, highlights some of the most prominent investment scams that seem to be on the rise.

06 December 2021: FNB Connect Vox Fibre for Business is officially here and is available for all FNB Business account holders. FNB CEO, Jacques Celliers and FNB Connect CEO, Bradwin Roper, share their thoughts on the exciting new offering.

28 November 2021: With the holiday season upon us, Head of Investment at FNB Wealth and Investments, Renzi Thirumalai, shares some insightful tips on what to consider before taking cash out of your pocket.

26 November 2021 FNB CEO, Jacques Celliers and CEO of FNB Merchant Services, Thokozani Dlamini, share their thoughts on the recent Black Friday transaction volumes. Chris Labuschagne, CEO of FNB Card, also elaborates further.

23 November 2021: Donald Khumalo, FNB HR Executive, explains why at FNB we believe that our people are the heartbeat of our organisation and they remain core to building life-changing financial services and fintech solutions for our customers. This achievement not only highlights our commitment to our employees but also signals our investment in building and growing top talent in South Africa.

18 November 2021: Referring to the recent rate hike, FNB CEO Jacques Celliers said that it was indicative of economic recovery amidst improving domestic demand, rising global inflation and normalising global interest rates. He also expressed hope that the national electricity grid could be stabilised to enable sustainable economic growth.

17 November 2021: Amid growing demand and with interest rates at an all-time low, FNB is proud to announce a deal with Balwin Properties that will make R450 million available for the development of Thabo-Echo Village. The deal cemented the bank's commitment to helping facilitate first-time homeowners entering the formal housing market.

10 November 2021: At the Global SME Finance Awards 2021, FNB was acknowledged in the Best Bank for Women Entrepreneurs category through an Honorable Mention for its Women in Business portfolio. FNB is committed to empowering female entrepreneurs and positively impacting the communities in which they operate.

08 November 2021: Head of Product at FNB Wealth and Investments, Samukelo Zwane, advises on structuring a retirement plan that evolves and grows, as we advance though our work lives.

04 November 2021: More than 25 000 businesses are now benefitting from industry-leading features through the First Business Zero Account, and over 192 000 entrepreneurs use Fundaba to increase their business knowledge and skills.

26 October 2021: At the Global SME Finance Awards 2021, FNB was acknowledged in the Best Bank for Women Entrepreneurs category through an Honorable Mention for its Women in Business portfolio. FNB is committed to empowering female entrepreneurs and positively impacting the communities in which they operate.

20 October 2021: Wycliffe Mundopa has won the 2021 FNB Art Prize receiving a cash prize and a solo exhibition at the Johannesburg Art Gallery. As the sponsor, FNB remains committed to empowering artists to become change agents in their communities through their artwork.

18 October 2021: Retire comfortably with complete peace of mind and the financial wellbeing you deserve when you turn sixty by following these five crucial steps.

11 October 2021: FNB Public Sector CEO, Sipho Silinda touches on FNB's partnership with the Road Traffic Management Corporation, and the new online payment gateway enabling motorists to easily renew and pay for their license discs.

06 October 2021 As a leader in innovation, FNB continues to invest significantly in creating new platform-based capabilities and solutions to ensure that it stays ahead of changing market dynamics and evolving customer needs.

Peruse the financial results infographic for an in-depth overview.

30 September 2021 FNB was once again recognised as one of the Most Valuable Brands in Africa according to the latest Brand Finance Africa 150™ 2021 valuation report. The bank was also the highest ranked banking brand in the continent.

16 September 2021 Positive results lead to a rebound in transactional activity, a growing customer base and a robust migration to FNB's digital platform. FNB CEO Jacques Celliers, shares his thoughts on the bank's solid earnings growth for the year ending 30 June 2021.

02 September 2021 As a purpose-led brand, FNB continues to push and redefine boundaries on what 'help' means to customers and society. This accolade is testament to the evolution of FNB to become more than just a bank, but rather a trusted financial services and lifestyle partner to their customers.

26 August 2021 With an FNB Shares Zero Account, customers can begin or expand on their journey of share ownership by investing in global stock markets while paying no monthly account fees.

25 August 2021 Matlhodi Leteane, Head of Operations at FNB Fiduciary, encouraged women to take control of their financial destiny by assessing and quantifying their current and future assets and utilising a professional to put together an estate plan.

17 August 2021 With the highly popular range of ETNs previously launched by FNB in 2020, the bank now looks to the expansion of their new ETNs having a value-added Environmental, Social and Governance (ESG) overlay, with the same low minimum investment of just R10.

10 August 2021 FNB's customers can now purchase smart devices over a 24-month repayment period via the FNB App - made possible by FNB Connect.

29 July 2021 With the success of FNB's graduate programme over the years, FNB's CEO Jacques Celliers explores how investing in high-quality local talent can inspire economies and businesses to unlock innovation, growth and social upliftment.

26 July 2021 FNB recognises the significant impact that the unrest has had on individuals, businesses, and regional economies of KwaZulu-Natal and Gauteng. This comes at a difficult time when South Africa is still grappling with the health and economic impact of the Covid-19 global pandemic.

22 July 2021 With FNB maintaining its prime lending rate at 7%, the bank's CEO Jacques Celliers praises SARB's decision to keep rates unchanged, enabling consumers and businesses to find relief.

13 July 2021 The devastating pandemic and subsequent lockdowns have reinforced the importance of saving for unforeseen emergencies and unplanned events. In order to accomplish this, as South Africans, we need to identify our personal savings goals and invest our extra funds in the appropriate savings vehicles.

07 July 2021 Head of Growth at FNB Fiduciary, Johan Strydom, touches on the three distinctive phases of financial needs that family members face, after a loved one passes away. He also explores how your life insurance should be able to support these phases.

07 July 2021 CEO of Public Sector Banking, Sipho Silinda touches on the demise of cheques in South Africa and the steady increase in the use of digital payment channels.

29 June 2021 FNB Economist, Thanda Sithole, is confident that a solid cyclical economic growth rebound is underway and South Africa is on a slow road to recovery.

28 June 2021 In the true spirit of help, FNB leadership, together with RMB, assisted Charlotte Maxeke Academic Hospital with repairs after half its property caught fire in April.

24 June 2021 Bobby Madhav, Head of Trade and Structured Trade and Commodity Finance at FNB, gives his views on fuelling South Africa's long-term economic recovery.

23 June 2021 South African youth (aged 18-34) are estimated to account for roughly a third of the country's population. At FNB, we believe that an early start to understanding effective money management will prepare them for a prosperous financial future. We want the youth to embrace, celebrate and inspire positive change through a deeper understanding of how they can achieve financial freedom and eliminate debt. Sometimes it's the smallest change in behaviour that makes the biggest difference.

21 June 2021 With DebiCheck being rolled out by all major banks, Head of the Commercial Transactional Pillar at FNB Commercial, Laura Deva shares her thoughts.

17 June 2021 Head of franchising at FNB Commercial, Morne Cronje shares on the challenges of growing a franchise network post Covid-19.

14 June 2021 Senior Agricultural Economist at FNB, Paul Makube, shares his thoughts on South Africa's well-established disease and pest management regime, as well as the overall risks involved.

10 June 2021 CEO of FNB Commercial Property Finance, Preggie Pillay and his team, urge SMEs to consider solar energy as a viable investment to help combat the losses experienced during power interruptions.

08 June 2021 Vaughan David, CEO of Cash Investments: Business at FNB, offers SMEs pockets of wisdom around cash flow management and how the FNB Business Call Account can cater to their specific needs.

07 June 2021 #TheChangeables celebrates and inspires positive change across Africa. In the spirit of change, FNB is also launching a refreshed design across its range of bank cards that will be made available to customers at no additional cost.

03 June 2021 FNB is keeping monthly account fees unchanged for business customers across the board for the third year running.

03 June 2021 FNB is keeping monthly account fees unchanged for business customers across the board for the third year running. Some transactions are also free or reduced - read more about how FNB helps business save every month.

03 June 2021 The new FNB Aspire bank account for middle-income customers will replace the current FNB Gold account. With the new bank account, customers can pay their account fees by using eBucks via the FNB App.

27 May 2021 For a fourth consecutive year, FNB has been voted as the most valuable banking brand in the 2021 Brand Finances South African 50 report, leading with a brand value of R22.1 billion.

03 May 2021 2021: Money Market funds and savings account are instruments used by investors and savers, looking to grow wealth in a risk averse manner. There are however key differences in the various savings solutions that investors and savers need to be aware of.

20 April 2021: FNB set a new norm for handling customer data in the South African banking industry. Customers can now update and manage their personal and business details to ensure compliance via a secure financial platform.

13 April 2021: Supporting your children with their physical, emotional, social, financial and intellectual development from a young age is critical before they mature into adulthood.

25 March 2021: Johannesburg: Following the South African Reserve Bank's (SARB) decision to keep the repo rate unchanged, FNB will similarly maintain its prime lending rate at 7%.

23 March 2021: FNB has made significant strides in supporting and becoming more relevant to community-based businesses. To reaffirm its commitment, FNB has acquired 100% of Selpal - a fintech company that operates specifically in townships and rural sectors of the economy.

18 March 2021: Practicing healthy money habits and adjusting how you do your everyday banking can go a long way in stretching your money further for your short and long-term goals. Over the years, FNB has been on a journey to help its customers to better manage their money through cost-effective financial solutions, a broad range of safer banking channels and meaningful value through eBucks, the best rewards programme in the industry.

11 March 2021: The first of March 2021 ushered in a new tax year for South Africans, which means it's a good time to invest some time and thought into how you put in place a well-considered money management plan for the coming 12 months.

11 March 2021: In many ways the Covid-19 pandemic brought out the best in mankind. At the height of the pandemic, people and organisations demonstrated levels of care and empathy that exceeded anything we have witnessed in recent history.

04 March 2021: First National Bank's (FNB's) performance for the six months to 31 December 2020 reflects some improvement in the operating environment despite sustained pressure on consumers and businesses due to Covid-19 and the related lockdown measures.

18 February 2021: Money matters and finances continue to be a widely talked about subject. The pandemic has not only been onerous and taxing on everyone's lives, but it has also created undue financial pressure on households globally.

10 February 2021: In 2020, the Bank offered digital platform -based Cashflow Relief to individuals and business customers, covering 700 000 agreements with loan balances in excess of R100 billion. FNB Life assisted with R300 million worth of Credit Life claims for customers who sadly were retrenched.

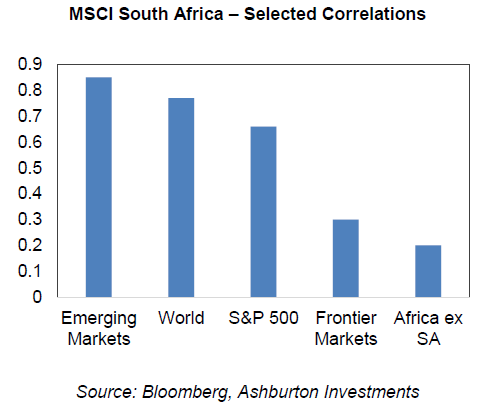

08 February 2021: 08 February 2021: A well-considered offshore investment or share trading strategy is an effective way of diversifying a portfolio geographically which, as the increased market volatility created by Covid-19 has demonstrated, should be a non-negotiable component of any investment strategy.

02 February 2021: eBucks is South Africa's leading rewards programme that has spent the past 20 years driving good banking behaviour and rewarding customers. To date, customers have redeemed R13.3 billion in eBucks through a network spanning 30 partners nationwide.

26 January 2021: FNB Life is rapidly transforming life insurance and providing digitally-led platform insurance solutions. FNB Life is the only insurance provider in South Africa that uses Home Affairs Data to proactively pay-out claims.

21 January 2021: With interest rates remaining unchanged, FNB CEO Jacques Celliers points out that although the Covid-19 pandemic continues to impact our society, there is room for relief if we all do our part.

19 January 2021: FNB was recently awarded top honours for both the mobile Banking App as well as the Internet Banking categories by SITEisfaction. See how the bank is further increasing its focus and investments on technology and data platforms to assist customers in 2021.

11 January 2021: This year, FNB is increasing its focus on building even more trust and further assisting their customers to thrive - despite increased economic uncertainty.

04 January 2021: FNB's market-leading approach to providing helpful and contextual financial solutions to support business customers has been recognised through the accolade of Global SME Bank of The Year at the Global SME Finance Awards Ceremony late in 2020.

28 December 2020 By 1 January 2021, individual consumers and businesses will no longer be able to cash cheques in South Africa. This follows a joint announcement by the SARB, FSCA, PASA and BASA which confirmed that the issuing and acceptance or collection of cheques will cease from 31 December 2020.

09 December 2020: Employees are challenged to constantly think differently, therefore innovation is embedded in their DNA - the longstanding Innovators programme showcases and celebrates platform innovations.

01 December 2020: Following the overwhelming response to the listing of Exchange Traded Notes (ETNs) on its platform, FNB is expanding the list of international companies available by adding Adobe, Ford, Activision Blizzard, Berkshire Hathaway, Goldman Sachs, JP Morgan, PayPal and Visa.

19 November 2020, Johannesburg: Following the South African Reserve Bank's (SARB) decision to keep interest rates unchanged, FNB confirms it will keep its prime lending rate at 7%.

09 November 2020: FNB has launched its latest edition of innovative nav» Smart Tools on the FNB App to help customers manage their money better through dynamic budgeting; as well as facilitating access to market and creating a digital marketplace for FNB-banked SMEs in the home services category.

28 October 2020: FNB announced as the SME Bank of the Year at the Global SME Finance Forum Virtual awards ceremony held on 27 October.

26 October 2020 FNB and the Shoprite Group have expanded their partnership by allowing FNB Easy Pay As You Use and Smart Option account holders to replace lost or stolen bank cards in more than 700 Shoprite and Checkers stores across South Africa.

=13 October 2020: SA Rugby and FNB confirmed on Tuesday that the South African banking giant has extended its sponsorship of the Springboks for a further five years.

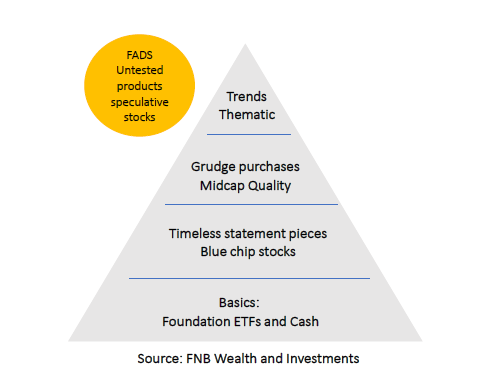

28 September 2020 - Building a balanced and well diversified portfolio is the aim of every long-term investor, but it can be easier said than done. Building your wardrobe is a far less daunting topic than building a portfolio, however both share similar characteristics.

7 October 202 First National Bank (FNB) has announced that individual consumers and institutional investors in South Africa will now have an opportunity to get exposure to shares from as little as R10 in some of the world's best performing companies such as Amazon, Facebook, Apple, Microsoft, Netflix, Tesla, Coca Cola and Alphabet which owns Google

05 October 2020 Many people still don't see the value of having a valid Will. However, the COVID 19 pandemic has encouraged people to pay more attention to their estate and assets. According to FNB, over the course of lockdown there has been an increase in the number of people who are taking interest in drafting or updating their Will.

17 September 2020 Following the South African Reserve Bank's decision earlier today to keep interest rates at their previous level, FNB confirms that it will maintain its prime lending rate at 7% and will review its position following the next SARB MPC meeting.

10 September 2020 First National Bank (FNB) presents it's annual results for the financial year ending 30 June 2020. The Bank acknowledges that the year has been very hard for many due to an economy that was already struggling before COVID-19, escalating health risks as well as financial difficulties for both customers and businesses.

02 September 2020 FNB has taken the top spot in the 2020 BrandZ Top 100 Most Valuable brands South African report. The report highlights that FNB is valued atR46.4 billion($2.8billion) and has risenin brand contribution with increased equity in all measures, and particularly in meaning and salience.

30 July 2020 FNB has launched its new brand campaign calling on all South Africans to rally behind local business to help rebuild the economy.

29 July 2020 FNB is expanding its digital payments ecosystem by launching a Virtual Card for individuals and businesses customers.

28 July 2020 Covid-19 lockdown regulations coupled with store closures have resulted in several consumers returning to online shopping for essentials products and services.

23 July 2020 Following the South African Reserve Bank's (SARB) decision to cut its lending rate by 0.25%, FNB will be reducing its prime lending rate to 7% from 7.25% with effect from Friday 24 July.

22 July 2020 At the beginning of this year, nobody could have predicted just how economically challenging the year 2020 was going to be.

Johannesburg, 16 July 2020 The stock market can be volatile, but it's a market that many people will delve into at some point in thier lives whether diretly buying shares or through their employer retirement saving fund.

16 July 2020 FNB Life is extending credit life insurance benefits to cover a portion of cashflow relief instalments for customers who already have credit life insurance. Under normal circumstances, customers pay an additional amount to extend insurance cover, however the provider is extending this benefit to protect quialifying customer against the financial impact of COVID-19.

13 July 2020: In the wake of the Covid-19 pandemic coupled with millions of South Africans going hungry daily due to adverse economic conditions, Grain Care and FirstRand SPIRE fund, through RMB and FNB have launched a substantial grain campaign aimed at providing maize meal to vulnerable communities.

08 July 2020: FNB and RMB in KwaZulu-Natal are facilitating the donation of masks to 80,000 families from vulnerable communities of the province. The initiative (KZN Maskathon) is part of the bank's wider response to the COVID-19 pandemic and aims to extend protection to people who cannot afford quality masks.

Johannesburg, 07 July 2020: FNB today announced that it will be discontinuing the issuing of cheques by 01 January 2021.

Johannesburg, 06 July 2020: Goals whether short or long-term form the foundations of your everyday life and your financial plan.

03 July 2020: The recent global health pandemic has caused uncertaintyfor people, business and investment experts across the globe. With low levels of confidence due to poor economic outlook and market volatility,South Africans are urged to look at their investment vehicles to determine which will offer the best returns given the current circumstances.

03 July 2020: In 2019, the Master of the High Court confirmed that as many as 75% of estates reported, are for South Africans who died without a valid Will. However, Johan Strydom, Head of Growth at FNB Fiduciary says that this may be set to change as people become more aware of their own mortality under the COVID-19 lockdown.

03 July 2020: Equity market instability and low cash interest rates have left savers and investors, both locally and abroad, taking another look at government bonds as a potential area of investment.

24 June 2020: First National Bank(FNB) has been voted as the best digital bank in the 2020 SIEisfaction®. The bank dominated overall customer satisfaction metrics in the both the Best Mobile Banking and Best Internet Banking categories

17 June 2020: First National Bank becomes the first bank in South Africa to accept UnionPay Contactless Payment at its SpeedPoint Terminals

01 June 2020: FNB has expressed its gratitude to employees, customers and partners for donating funds as well as eBucks to the FNB bank account that was created to support the National Solidarity Fund.

25 May 2020: Johannesburg - South Africans have spent most of the last 2 months at home on account of the national lockdown. Houses are being spring cleaned, people are clearing their to do lists and relationships are being maintained through technology.

24 May 2020: After a three-day policy meeting, the SARB's monetary policy committee (MPC) on Thursday decided to cut the repo rate by a further 50 basis points (bps) leaving the South Africa's prime lending rate at 7.25%.

22 May 2020: Through the national Maskathon Initiative, FNB has donated 30 000 fabric-face masks to underprivileged and non-governmental organisations throughout the country.

21 May 2020: Following the South African Reserve Bank's (SARS) decision to cut its lending rates by a further 50 points, FNB confirms that it will reduce its prime lending rate to 7.25% from 7.75% with effect from 22nd May 2020.

20 May 2020: In a bid to extend help to a boarder range of small business, FNB has committed R8 million in grant funding to enable micro-entrepreneurs to resume work during and post the Covid-19 pandemic.

14 May 2020: A recent rapid response survey by Stats SA revealed that a staggering 42% of respondents were not confident of being able to continue operations post the COVID-19 outbreak.

12 May 2020: FNB has zero-rated transaction fees on its prepaid airtime, voice, SMS and data bundle purchases for customers who hold its Easy-As-You-Use, Islamic Easy-As-You-Use Account with Zero monthly account fee. This now follows theEasy Zero bank account where prepaid purchases have always been free.

11 May 2020: FNB has received an overwhelming number of application for SAFT funding support from business clients that were impacted by COVID-19. The South Africa Future Trust (SAFT) fund was established by the Oppenheimer family to provide financial support to the employees of qualifying SME's, FNB has been assisting SAFT as an agent to help deploy these funds.

06 May 2020: FNB and Wesbank have approved payment breaks on more than 500 000 credit agreements for nearly 150 000 individuals and business customers since 1 April 2020.

05 May 2020: Following an unscheduled meeting on Tuesday, the SARB's Monetary Policy Committee (MPC) unanimously decided to cut the repo rate by another 100 basis points(bps) to 4.25%, leaving the prime lending rate at 7.75%.

05 May 2020: South Africa's All Share Index has plummeted to levels not seen for more than six years. This has been on the back of the COVID-19 outbreak globally and the declaration of national state disaster in South Africa.

05 May 2020: Following the South African Reserve Bank's decision to cut its lending rate by a further 1%, FNB confirms that it will reduce its prime lending rate to 7.75%.

05 May 2020: Given the recent market volatility that has impacted South Africa, the FNB Equity Research team have collated insights on the best long-term and affordable local stocks to invest in now.

05 May 2020: Unit trusts can be a fantastic instrument for the beginner investor, looking for access to the markets but through a professional fund.

05 May 2020: Headlines last week highlighted an unprecedented fall in oil prices to below zero.

05 May 2020: A KwaZulu-Natal based FNB customer won R135 million from the PowerBall draw after he purchased a R100 Quick Pick ticket through the FNB online banking platform yesterday.

29 April 2020: FNB has welcomed the President's announcement of the R200bn COVID-19 Loan Scheme to enable commercial banks to help businesses that are unable to meet their financial obligations during lockdown thus ensuring their resilience for when the economy reopens.

23 April 2020: As the country continue to observe the national lockdown, and Early Childhood Development (ECD) Centres remain closed, many children across South Africa who rely on the food provided by their ECD centres, no longer have access to their daily meals.

21 April 2020: In the second half of 2008: Oil prices dropped to a third of the price at the beginning of the period. The Rand depreciated by about 30% to the US Dollar. The US Federal Reserve cut uts benchmark interest rate effectively to zero. The JSE all share index lost about a third of its value.

15 April 2020: We remain committed to helping our business customers whose financial position has been impacted by COVID-19. The submission of the SME Assessment will be used as an application for SAFT funding as well as various other relief measures offered by FNB and other providers.

06 April 2020 - In addition to the various COVID-19 measures implemented to provide relief to individual and business customers, FNB has further committed to helping small businesses with alternative funding support, critical business support resources, links to various government resources and private funding initiatives.

03 April 2020 - FNB Connect will reduce data prices by up tp 55%, in April 2020. In addition, FNB Connect will double customers' data on their Lifestyle plans without any price increase.

2 April 2020 - First National Bank (FNB) has announced a new strategic partnership with Clicks as the executive health and beauty rewards partner. Members of FNB rewards programme eBucks, can now earn and spend eBucks at over 650 Clicks stores nationwide and online.

1 April 2020 - As consumers continue to weigh the impact of COVID-19 on their finances, many will be considering options to protect themselves from financial difficulties.

30 March 2020 - In recent weeks, the South African Government, business community, philanthropists and society at large have shown remarkable unity in a joint effort to protect our country against the impact of COVID-19.

23 March 2020 - As South Africa and the international community continue to intensify efforts to curb the spread of COVID-19, FNB has reaffirmed its commitment to help SMEs and individual customers whose financial position is adversely impacted by COVID-19.

19 March 2020: Johannesburg: Following the South African Reserve Bank's (SARB) decision to cut its lending rate by 1%, FNB confirms that it will reduce its prime lending rate to 8.75% with effect from Friday 20 March 2020.

10 March 2020: Against the backdrop of an increasingly tough economic climate, FNB has once again delivered solid interim results for the six months to 31 December 2019.

19 February 2019: The use of video and music streaming services is rising significantly as South African consumers continue to look for ways to be entertained at a fraction of the usual cost.

13 February 2019: FNB has been ranked Africa's most Reputable and Innovative banking brand in the 2020 Brand Finance® Banking 500 survey.

10 February 2020: Restaurants continue to enjoy the lion's share of consumer spending during Valentine's Day. According to FNB, on Valentine's Day in 2019, its customers spent approximately R50 million at different restaurants around the country.

13 February 2019: FNB has been ranked Africa's most Reputable and Innovative banking brand in the 2020 Brand Finance® Banking 500 survey.

28 January 2020: FNB customers who use cellphone banking are now also able to track their spending activities, view available funds as well as their FNB credit status.

28 January 2020: FNB is hosting the 8th Franchise Leadership Summit on the 3rd of March 2020 at Montecasino, Johannesburg.

27 January 2020: To kick start the year and ensure an easy landing into a new world for 2020 students, FNB will be owning Wednesdays by introducing Akulaleki Wednesdays with Happy Data hour and KFC vouchers.

21 January 2020: Entrepreneurs who are starting new businesses are urged to carefully consider the legal status and type of business being registered, as it can have both cost, tax and legal implications in the long-term.

14 January 2020: Following the recently announced rules from the Payments Association of South Africa (PASA) to reduce the maximum value of cheque limits to R50 000, businesses are urged to adopt electronic banking channels.

12 January 2020: Last week's rate cut by the South African Reserve Bank (SARB) provides a bit of a relief to consumers and businesses. It provides consumers with the opportunity to look at how they can maximise their savings and stokvel investments to help them save for those additional goals in the longer term.

02 December 2019: The Innovators programme allow employees to lead the evolution of the business from a digital era to platform era. Building a trusted platform creates contextual solutions for customers, with both employees and customers using the same technology. The aim is to provide a consistent customer experience across digital interfaces.

14 November 2019 - FNB today launched Easy Zero, a fully-fledged digital bank account with a card to allow customers to transact easily, conveniently and safely without paying a monthly fee. The mobile account was formerly known as eWallet eXtra.

11 November 2019 - FNB customers have made over R14 billion in 'tap' or contactless payments in the twelve months to June 2019, with continued month-on-month growth. This upward trend points to growing appetite for the convenience of contactless payments in South Africa's consumer and business sectors.

06 November 2019 - Fifteen of the most innovative and dynamic businesses in South Africa will be contending for the much sought-after accolade of the 'FNB Business Innovator of the Year 2019' during a gala dinner to be held on 21 November at the Galleria in Sandton.

31 October 2019 - FNB's eBucks Rewards programme has been awarded the Best Programme of the Year 2019 (financial services) and the Most Innovative Use of Technology for Loyalty award at the Loyalty Awards South Africa ceremony held on Wednesday in Cape Town.

15 October 2019 - FNB's eBucks Rewards programme has been awarded the Best Programme of the Year 2019 (financial services) and the Most Innovative Use of Technology for Loyalty award at the Loyalty Awards South Africa ceremony held on Wednesday in Cape Town.

Johannesburg, 5 September 2019 - FNB Business is living up to its commitment to help South African entrepreneurs by launching new products and solutions that it believes will help increase the level of SME activity and create a culture of entrepreneurship in the country.

Tuesday 20 August 2019: FNB and Disney Africa announced a collaboration to bring a series of family-orientated Disney LIVE events over the course of the next year to South African audiences.

01 June 2019: FNB continues to provide the best value to its customers through reduced monthly fees, improved potential to earn eBucks, and now offers customers free FNB Connect benefits on cheque accounts.

01 June 2019: eBucks Rewards members will have an opportunity to earn Double their fuel rewards on a quarterly basis with up to R8* back in eBucks per litre at Engen fuel stations. Other new earn categories that are launching include earning up to 15% back in eBucks at KFC stores and up to 40% back in eBucks on InterCape bus rides for FNB Gold customers.

29 April 2019: Following overwhelming responses from entrepreneurs, the FNB Business Innovation Awards (FNB BIA) have been extended to include two more categories, and now represent the entire business landscape in South Africa.

03 May 2019: In the aftermath of the natural disasters that affected parts of KwaZulu Natal, Eastern Cape and Mozambique, FNB has initiated the #HelptoRebuild initiative. The initiative is an appeal for help to customers and broader society to contribute towards relief efforts for displaced people and communities in the affected areas.

15 April 2019 : South Africa's middle-income consumers on average spend 25% of their take home monthly income to pay interest accumulated on debt.

FNB has welcomed the judgement delivered by the Equality Court on 10 April 2019 to dismiss the matter relating to allegations of racial discrimination on interest rates by Saambou Bank.

8 April 2019 : First National Bank (FNB) has launched a new functionality on its banking app that enables customers to shop directly from the app. The eBucks Shop, which was previously only accessible on the eBucks website, offers customers exclusive pricing for products ranging from tech and gaming to appliances and outdoor.

20 March 2019: FNB has revealed that consumers have sent over R12.8 billion worth of eWallet funds from 22 million eWallet transactions processed between July and December 2018. This is a 25% year on year increase in the value of funds that consumers have sent via eWallet.

You use the information contained on this page (the "Information") at your own risk. First National Bank, a division of FirstRand Bank Limited ("the Bank"), provides no warranties or guarantees, whether express, implied or otherwise, in respect of the Information, its accuracy and/or reliability. Without limitation, the Bank does not warrant that the Information will ensure your compliance with accounting, auditory, financial, legal, business and/or tax requirements or will improve your business' performance. The Information does not constitute advice and should not be used as a substitute for obtaining professional or other advice where necessary. Neither the Bank nor its holding company, subsidiaries or other group companies will be liable to you for any claims, demands, expenses, costs, losses or damages, of whatsoever nature, suffered or incurred by you in respect of your use of the Information.

The Bank is the owner of the copyright in all content on this page. You may not publish, modify or adapt this content in any medium or format without the prior written consent of the Bank.

Social media scams to lookout for in the New Year

Consumers are spending a large part of income on food, transport

Key franchising trends to consider for 2018

Five things SME's need to be thinking about in 2018

Franchising sector - The year that was

Bounce back after the holiday season!

Have you set your financial new year's resolutions?

SA's medical tourism an untapped treasuretrove

The digital revolution and the trending themes in 2018

Multi-unit franchising growing in South Africa

Launch a business on a shoe-string budget and your smartphone

FNB Business Innovation Awards 2018 judges announced

Day Zero only paints half the picture

What to consider when planning for retirement?

Taking out debt for a bond deposit is risky

Put your loved ones in a better financial position this Valentine's

How to get a good home loan interest rate?

Effective savings strategies to follow

Save for your child's education

Use your home loan account to save money

Consumers urged to tighten belt as cost of living soars

Save now so you can retire comfortably

Create a goal-based savings mindset

Common myths about hospital cash plans

Agriculture proves to be a heavy lifter

Diminishing Musharaka, an alternative way to buy property

How the Eastern and Western Cape Water levels will impact Easter tourism numbers

FNB's parent company FirstRand awarded short-term insurance licence

Should you sell your investment property?

FNB life surpasses 1 million funeral policy milestone

Factors to consider when ceding your life policy

Is your life insurance enough to cover your family?

Money mistakes wealthy people should avoid in marriage

Don't overlook the benefits of checking your bank statement

How to trim down SME running costs

Do you really get what you need from your bank?

Strongest Banking Brand in Africa

Factors to consider when buying a second house

FNB unveils FNBy and FNB Fusion Premier Accounts

Tips to help you prevent card fraud

Current challenges faced by new franchisees

BrandsEye Takes Top Honours at FNB Business Innovation Awards

Top 5 tips to achieve financial independence

Home loan application is approved - what next?

Questions to ask when taking out a funeral policy

Are your kids ready for their inheritance?

Money mistakes the youth must avoid

5 things to consider before switching banks

Principles of a successful scale up

5 habits that stop you from building your savings

What happens when you pass away without a will?

Consumers in the dark about disability insurance

SA's first banking app now free across all networks

FNB unveils unveils how the WC agriculture impacts SA GDP

Consumers in the dark about disability insurance

IFC Initiates Push to Support South African SMEs

SA's first banking app now free across all networks

FNB unveils unveils how the WC agriculture impacts SA GDP

What documents do you need to open a bank account?

Is fixing your home loan interest rate ideal?

Tips to save on funeral insurance

International travel scams to look out for when traveling overseas

Long-term investing: hold gold in portfolio mix

Managing input costs in animal & grain farming

Why SA needs more new franchises to create more jobs

6 Considerations to keep SA competitive in Freight Forwarding and Logistics

Make saving part of your lifestyle

SA's low growth economy presents cashflow challenges for SMEs

Signs you are misusing your credit card

You are never too young to get life insurance

Put in a little extra in your retirement savings

The dti and FNB sign pledge to improve access to finance for black industrialists

FNB Islamic Banking nominated for Best Islamic Banking Window for 2017

Pros and Cons of a joint home loan

Best way to keep a healthy bank account

The rise of women in franchising

A health cash plan can cover loss of income